Ever wondered if your marketing and sales efforts are actually making you money? A customer acquisition cost calculator is the tool that stops the guesswork. It puts a hard number on what it costs to land a new customer, turning a jumble of expenses into a metric you can actually use.

What Really Goes Into Your Acquisition Cost

Before you can punch numbers into a calculator, you need a solid grip on what Customer Acquisition Cost (CAC) actually is. Think of it as a financial health check for your growth strategy. It’s the clearest line you can draw between your spending and your results, telling you if you're building a sustainable business or just spinning your wheels.

And I don't just mean your ad spend. To get this right, you have to account for every single dollar that helps bring a new customer in the door. If you miss a component, you'll get a dangerously misleading number, making you think your marketing is way more efficient than it really is.

The Core Components of CAC

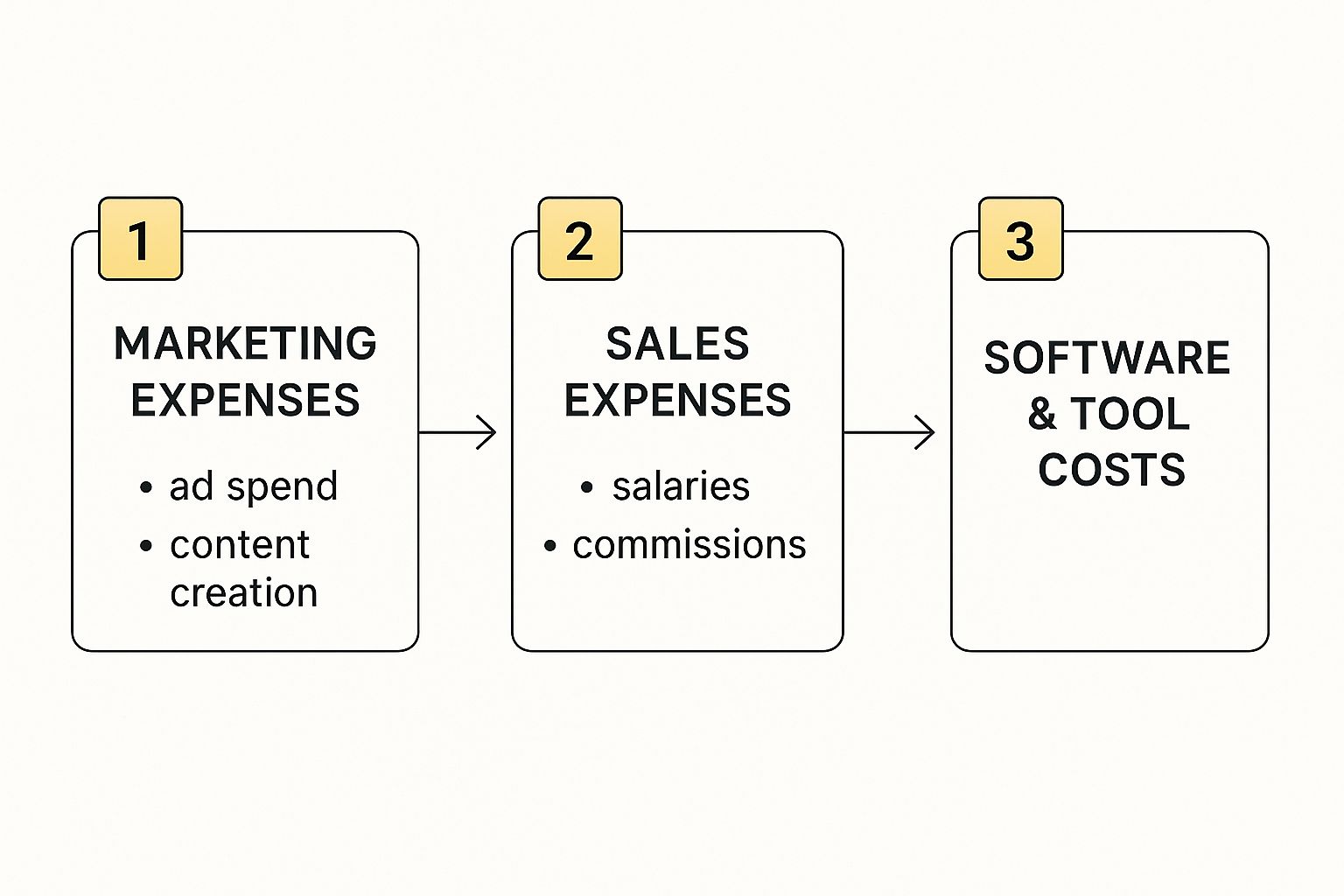

To get an accurate figure, you need to pull in expenses from three main buckets: marketing, sales, and the tech that holds it all together. This is the only way to capture the full investment you're making.

This infographic breaks down how those costs all flow into your total acquisition spend.

As you can see, a true CAC isn't just one thing—it's the sum of your marketing, sales, and technology costs. It's a holistic view of your entire acquisition engine. The concept is pretty similar to other direct response metrics, and understanding something like Cost Per Acquisition (CPA) on Amazon can help put it all in perspective.

To make this easier, here’s a quick rundown of the key costs you should be tracking.

Essential Components of a CAC Calculation

Here's a quick summary of the key cost categories to include when calculating your Customer Acquisition Cost.

| Cost Category | Examples of Expenses |

|---|---|

| Marketing Costs | Ad spend (Google, social media), content creation, SEO agency fees, marketing event sponsorships, affiliate commissions |

| Sales Costs | Sales team salaries and commissions, sales bonuses, travel expenses for client meetings |

| Salaries & Overhead | Salaries of marketing and sales staff, a portion of overhead costs like office rent and utilities |

| Technology & Tools | CRM software (e.g., HubSpot), marketing automation platforms (e.g., Mailchimp), analytics tools, website hosting |

Remember, the goal is to be thorough. A forgotten expense can skew your numbers and lead to poor decisions down the line.

Why Precision Matters More Than Ever

Nailing down these costs has become absolutely critical. Why? Because over the last decade, getting new customers has become wildly more expensive across the board. Markets are crowded, and businesses are spending a lot more just to get noticed, let alone convert a lead.

The numbers are pretty staggering. The average CAC has shot up by 222% between 2013 and 2025. A decade ago, businesses were losing about $9 per new customer; that figure is now projected to hit $29. That's a huge shift, and it highlights just how fierce the competition has become.

Your CAC is more than just a number; it's a story about your business's efficiency. A low CAC suggests a strong product-market fit and effective marketing, while a high CAC can be an early warning sign of deeper strategic issues that need immediate attention.

Putting the CAC Formula into Practice

Knowing the theory is one thing, but actually rolling up your sleeves and calculating your Customer Acquisition Cost is where the magic happens. The formula itself is refreshingly simple: just add up all your marketing and sales costs for a specific period, then divide that total by the number of new customers you brought in during that same window.

The real challenge isn't the math—it's the discipline of tracking everything accurately. Let's walk through a couple of real-world scenarios to see how different businesses tackle this.

Example 1: The Small Ecommerce Store

First up, let's imagine a small online shop called "Crafty Creations" that sells handmade jewelry. They want to figure out their CAC for the month of April. To do this, they need to pull together every single dollar they spent on getting new customers.

Here’s what their monthly costs look like:

- Google Shopping Ads: $2,500

- Facebook & Instagram Ads: $1,500

- Influencer Collaborations: $1,000 (for two influencers who posted in April)

- Email Marketing Software (Klaviyo): $150

- Graphic Designer (part-time): $500

When they add it all up, their total acquisition cost is $5,650.

During that same month, they acquired 250 new customers. Now for the easy part:

$5,650 / 250 New Customers = $22.60 CAC

So, on average, Crafty Creations spent $22.60 to win each new customer in April. That number is now a critical baseline. They can use it to gauge how their campaigns are performing next month and see if they're getting more or less efficient.

Example 2: The B2B SaaS Company

Now for a more complex business: a B2B SaaS company named "SyncUp" that sells project management software. Their sales cycle is much longer, and their costs are spread out across different departments. They're calculating their CAC for the entire first quarter (Q1).

Their expenses include direct ad spend and the salaries of their growth-focused teams—a crucial detail many businesses miss.

Q1 Sales & Marketing Expenses:

- Sales Team Salaries & Commissions: $75,000

- Marketing Team Salaries: $40,000

- LinkedIn Ads Spend: $15,000

- Content Marketing (freelancers & tools): $8,000

- CRM & Sales Software (HubSpot): $5,000

- Trade Show Booth & Travel: $12,000

The grand total for SyncUp's acquisition costs in Q1 comes out to $155,000.

Over that same quarter, the sales team successfully closed deals with 125 new companies.

$155,000 / 125 New Customers = $1,240 CAC

SyncUp's CAC of $1,240 is worlds away from the e-commerce store's, but that’s completely normal for B2B. The customer lifetime value is significantly higher, which justifies the bigger upfront investment. The key takeaway? The formula works no matter the scale of your business.

For businesses with longer sales cycles like SyncUp, it’s crucial to match costs to the correct acquisition period. A common mistake is attributing March's marketing spend to customers who signed in March, even if those leads first engaged 90 days ago. This is where truly understanding your customer journey pays off.

This brings us to the more advanced topic of marketing attribution. Nailing down exactly which marketing touchpoints led to a conversion is essential for an accurate, channel-specific CAC. We dive deeper into this in our guide on what is marketing attribution.

Ultimately, whether you're selling a $20 bracelet or a $20,000 software subscription, the core logic of calculating CAC stays exactly the same.

Using a CAC Calculator for Strategic Insights

This is where the real magic happens. Moving beyond manual math and into a dedicated customer acquisition cost calculator—whether it's an online tool or a spreadsheet you've perfected—is how you start unlocking genuine strategic power. The mechanics are simple enough: you plug your total sales and marketing costs into one field and the number of new customers into another.

But the real challenge isn’t using the tool; it’s gathering clean, accurate data to feed it. A calculator is only as good as the numbers you put in. That means you need a consistent process for tracking every single relevant expense, from ad spend and software subscriptions to sales commissions and content creation fees.

Choosing the Right Time Frame

One of the first calls you'll have to make is picking the right time frame for your analysis. Honestly, there's no single correct answer here. It all comes down to your business model and sales cycle.

- Monthly CAC: This is perfect for businesses with short sales cycles, like most e-commerce brands or B2C services. It gives you a frequent, up-to-date pulse on your marketing efficiency, letting you react quickly to what’s working and what isn’t.

- Quarterly CAC: For B2B companies or anyone with a longer consideration period, a quarterly view is often way more practical. It smooths out those month-to-month bumps and better reflects a sales process that might take a few months from that first touchpoint to a signed deal.

Whatever you choose, the key is to be consistent. Comparing a monthly CAC to a quarterly one is like comparing apples to oranges—it won't give you a clear picture of your performance trends.

Segmenting Costs for Deeper Insights

A blended CAC, where you just average all your costs and customers together, is a decent starting point. But the real gold is in segmenting your data to calculate a channel-specific CAC. This is what shows you the true performance of your individual marketing efforts.

By isolating the costs and customers from each channel, you get a much clearer picture. You might discover that your Google Ads campaigns have a CAC of $50, while your content marketing is pulling in new customers for just $25.

This level of detail transforms your CAC from a simple health metric into a powerful decision-making tool. It tells you exactly where to double down on your investment and which channels might need a rethink or some serious optimization.

This channel-specific approach is also fundamental to measuring return on marketing investment, because it directly ties what you spend to the results you get. With a reliable customer acquisition cost calculator, you can finally stop guessing and start making data-driven decisions that fuel efficient, sustainable growth.

Turning Your CAC into Actionable Growth

Knowing your Customer Acquisition Cost is a solid start, but that number doesn’t live in a vacuum. By itself, it can't tell you if your business is healthy or on a crash course.

To turn that single metric into a genuine growth lever, you have to pair it with another powerhouse KPI: Customer Lifetime Value (LTV).

LTV is the total revenue you can reasonably expect from a single customer over their entire relationship with your brand. When you put LTV and CAC side-by-side, you finally get the full story of your business's sustainability.

The Power of the LTV to CAC Ratio

The LTV:CAC ratio is the ultimate report card for your marketing and sales efficiency. It directly compares how much a customer is worth against what it cost to get them in the door. The math is simple: a healthy business has to make more from its customers than it spends acquiring them.

Think of it this way: if your LTV is $300 and your CAC is $100, your LTV:CAC ratio is 3:1. For every dollar you spend to get a customer, you're getting three dollars back over their lifetime. This is widely seen as the gold standard for a healthy, scalable business.

A 1:1 ratio means you're breaking even—at best. You're basically spending a dollar to make a dollar. While not a total disaster for a brand-new startup finding its footing, it's completely unsustainable long-term. On the flip side, a ratio of 5:1 or higher might suggest you're underinvesting in growth and could be acquiring customers even faster.

Putting Your Ratio into Context

So, is your CAC "good"? The only way to know for sure is to see how it stacks up against your industry.

For example, in 2025, the average customer acquisition cost in the ecommerce sector hovers between $70 and $78 globally. Of course, this number can swing wildly based on your specific market and product, but it gives you a useful benchmark. You can dig into more average acquisition costs on usermaven.com.

If your ecommerce store's CAC is $120 while the industry average is $75, that's a red flag. It’s a sign your competitors might be acquiring customers more efficiently, and it's time to take a hard look at your strategy.

Identifying Red Flags and Pivoting Strategy

Think of your LTV:CAC ratio as an early warning system. It helps you spot problems before they sink the ship. Here are a few red flags and what to do when you see them:

-

A Declining Ratio: If your 3:1 ratio last quarter is now 2:1, something’s up. Are your ad costs creeping higher? Is customer churn on the rise, dragging down your LTV? This is your cue to investigate specific channels and double down on retention.

-

A Long Payback Period: This is how long it takes to earn back your initial CAC. If your CAC is $500 and your customer pays $50/month, your payback period is 10 months. But if most customers are churning after six months, you're consistently losing money on every new sign-up.

-

Channel-Specific Imbalances: Don't just look at your blended, overall ratio. Your real insights are hiding in the channel-specific data. If your Google Ads LTV:CAC is a healthy 4:1 but your Facebook Ads ratio is a dismal 1:1, you have a clear signal. It's time to reallocate your budget, shifting funds from the underperformer to the channel that’s actually driving profitable growth.

Using a customer acquisition cost calculator is the first step. The real magic happens when you consistently track your LTV:CAC ratio, benchmark it against your industry, and use the insights to make sharp, data-driven decisions.

Proven Ways to Lower Your Acquisition Costs

So you’ve run the numbers through a customer acquisition cost calculator and stacked them up against your LTV:CAC ratio. The result? Your spending is a little higher than you’d like. I’ve been there, and the good news is that high acquisition costs aren't a life sentence. With a smart, focused strategy, you can bring that number down without stalling your growth.

The trick is to look beyond just slashing your ad budget. A much better approach is to optimize every single step of your customer journey, from that first click to the final sale. This builds a more efficient engine that turns prospects into customers for less money.

Optimize Your Paid Advertising Channels

For a lot of businesses, paid ads are the biggest single line item in the marketing budget. It’s also where small, consistent tweaks can make a huge difference to your overall CAC. You can’t just set your campaigns to autopilot and hope for the best; active management is the name of the game.

Here are a few high-impact tactics I always come back to:

- Refresh Ad Creative: Ad fatigue is a real conversion killer. I make it a point to regularly update visuals and copy to keep audiences engaged. You'll see your click-through rates thank you for it.

- Refine Audience Targeting: Dive deep into your data. Are you still targeting broad audiences when you could be zeroing in on more specific, high-intent segments? Get granular.

- Test New Ad Formats: Don't get stuck in a rut. Experiment with video ads, carousels, or interactive formats to see what actually resonates with your audience and drives conversions at a lower cost.

Boost Your Website Conversion Rate

Driving traffic to your website is only half the battle. If your landing pages aren’t converting those hard-won visitors into leads or customers, you're basically lighting your ad spend on fire. Every bit of friction on your site—a slow-loading page, a confusing form—inflates your CAC.

A small bump in your conversion rate can lead to a massive drop in your customer acquisition cost. Think about it: if you can get 2% of visitors to convert instead of 1%, you’ve just cut your CAC in half without spending a single extra dime on ads.

Improving your site's performance is one of the most sustainable ways to lower acquisition costs for the long haul. Start by analyzing user behavior, fixing any broken links, and making sure your calls-to-action are impossible to ignore. For a deeper dive, our guide on https://upnorthmedia.co/blog/conversion-rate-optimization-strategies gives you a full roadmap.

If you’re looking for more practical strategies, check out these proven ways to reduce your customer acquisition cost. Just implementing one or two of those ideas can start moving the needle in the right direction.

Common Questions About Calculating CAC

Even with a calculator in hand, a few questions always pop up when you start digging into your customer acquisition cost. Let's tackle some of the common hangups to make sure the numbers you're getting are actually useful.

What Time Frame Should I Use?

One of the first things people get stuck on is the timeframe. Should you be looking at your CAC monthly, quarterly, or annually? It really depends on your sales cycle.

For businesses where customers buy quickly—think e-commerce or DTC brands—a monthly calculation is your best bet. It gives you fast, almost real-time feedback on your campaigns.

But if you're in B2B, where a deal might take months to close, a monthly view can be super misleading. A single big deal closing (or not closing) can throw your numbers way off. For longer sales funnels, a quarterly or even annual CAC smooths out those peaks and valleys, giving you a much more stable and accurate picture.

What Costs Should I Actually Include?

This is a big one. It’s so tempting to just plug in your ad spend and call it a day, but that gives you a dangerously rosy view of your acquisition cost. To get a true CAC, you have to be honest about all the costs involved.

For a complete and accurate calculation, you need to include:

- Team Salaries: The salaries (or a percentage of them) for your marketing and sales teams. Their time and effort are a direct cost of acquiring new customers.

- Software and Tools: Don't forget the money you spend on your CRM, email marketing platform, analytics tools, and anything else in your marketing stack. It all adds up.

- Creative and Content Costs: Did you hire a freelance writer? Pay a graphic designer for new ads? Produce a video? All of that belongs in your calculation.

The rule of thumb is simple: if a cost is part of the process of attracting and converting a prospect into a customer, it belongs in your CAC calculation. Excluding costs doesn't make your marketing more efficient; it just hides the true price of growth.

How Do I Handle Big, One-Off Marketing Expenses?

So what happens when you have a massive, one-time expense? Maybe you sponsored a huge industry conference or ran a big brand awareness campaign for $50,000. If you dump that entire cost into a single month's calculation, your CAC for that month will look catastrophic.

For these large, irregular expenses, the best approach is to amortize the cost. That's just a fancy way of saying you should spread it out over a longer period, like six months or a full year.

This way, that single event doesn't wreck your monthly reporting. It gives you a more realistic view of your ongoing acquisition efficiency and helps you spot the trends that actually matter.

Ready to stop guessing and start making data-driven decisions? The team at Up North Media can help you implement a robust SEO strategy to lower your acquisition costs and attract high-value customers. Get your free consultation today and see how we can fuel your growth.